VAT treatment on directors’ fees – Luxembourg VAT Circular 781-1 published today

On 21 December 2023, the European Court of Justice (ECJ) ruled on the VAT treatment of the director’s fees and the qualification of members of board of directors as VAT taxable persons.

As a reminder, a taxable person is considered as “any person who, independently and on a regular basis, in the course of a general economic activity, carries out transactions, whatever the purpose, results or place of that activity”.

The ECJ ruled that, on the circumstances of the case at hand, and under conditions, the member of the board of directors of a public limited company under Luxembourg law carries out an economic activity.

However, with regards to the criteria of independence, the activity of a member of the board of directors of a public limited company under Luxembourg law is not carried out independently where he or she does not act on their own behalf or under their own responsibility and does not bear the economic risk linked to their activity.

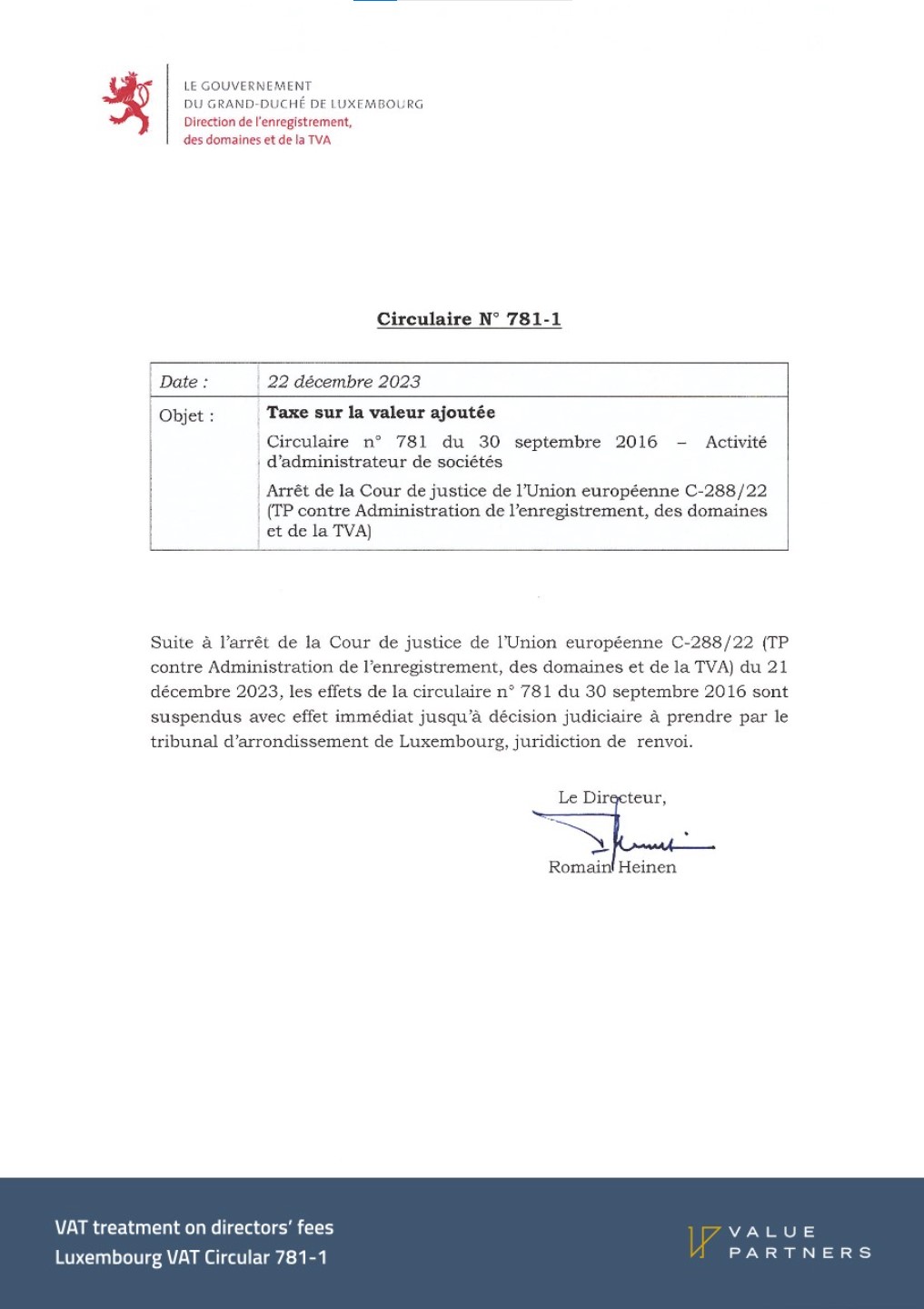

This decision represents a change in the Luxembourg’s VAT practice, which has already been updated today by the VAT administration with the publication of Circular 781-1, cancelling the effect of Circular 781 until the National Court’s decision.

Should you need any information in this regard, please contact Steve Georges, Director, VAT Services.

VAT treatment on directors’ fees – Luxembourg VAT Circular 781-1 published today

On 21 December 2023, the European Court of Justice (ECJ) ruled on the VAT treatment of the director’s fees and the qualification of members of board of directors as VAT taxable persons.

As a reminder, a taxable person is considered as “any person who, independently and on a regular basis, in the course of a general economic activity, carries out transactions, whatever the purpose, results or place of that activity”.

The ECJ ruled that, on the circumstances of the case at hand, and under conditions, the member of the board of directors of a public limited company under Luxembourg law carries out an economic activity.

However, with regards to the criteria of independence, the activity of a member of the board of directors of a public limited company under Luxembourg law is not carried out independently where he or she does not act on their own behalf or under their own responsibility and does not bear the economic risk linked to their activity.

This decision represents a change in the Luxembourg’s VAT practice, which has already been updated today by the VAT administration with the publication of Circular 781-1, cancelling the effect of Circular 781 until the National Court’s decision.

Should you need any information in this regard, please contact Steve Georges, Director, VAT Services.